Market News

Weak dollar, growing risk appetite vault some of year's lagging emerging market ETFs - SEEKING ALPHA

By: Vishesh Kumar, SA News Editor

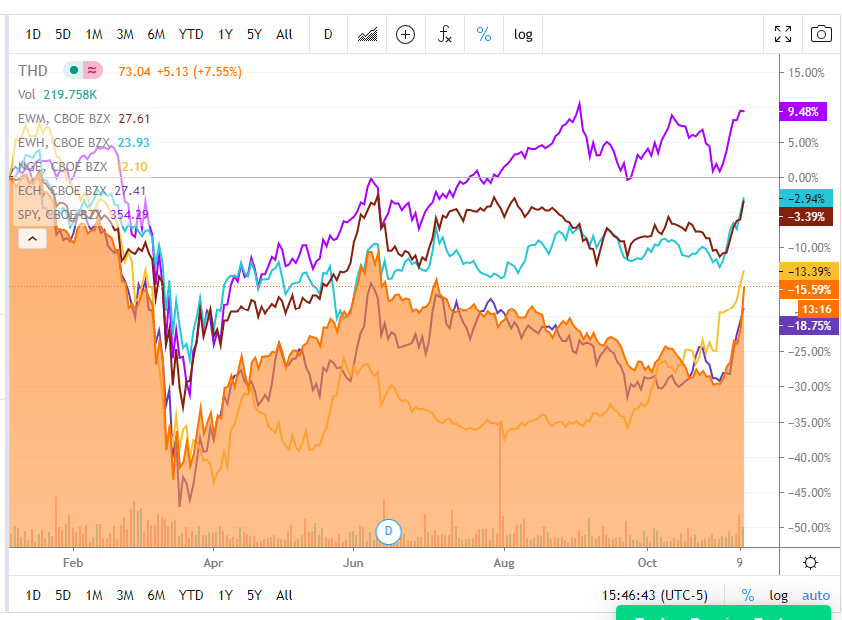

- The weak dollar and booming risk appetite in the wake of the U.S. presidential election is adding a tailwind for some emerging markets ETFs that have trailed during the year.

- Country ETFs for Thailand (NYSEARCA:THD), Malaysia (NYSEARCA:EWM), Hong Kong (NYSEARCA:EWH), Nigeria (NYSEARCA:NGE), and Chile (BATS:ECH) were the biggest gainers Tuesday of the ETFs monitored by the Seeking Alpha Country ETF tracker.

- THD, EWM, and EWH were the biggest gainers of the group with gains of 7.6%, 2.7%, and 2.5% respectively. The gain for the THD is the largest since March 17.

- Despite the day's gains, the group has trailed U.S. markets YTD. THD, ECH, and NGE have lost 23%, 16%, and 12% YTD respectively.

- The reversal mirrors others taking place in the markets in recent days. The Nasdaq, a leader over the year, tumbled while the Dow and small caps made gains.

- Many emerging markets rely on dollar-denominated debt to fund their deficits, so a weakening dollar may be boosting their fortunes by making financing less expensive.

- Emerging market stocks tend to be riskier than their domestic counterparts. Growing risk appetite in the markets could be adding to their tailwinds.

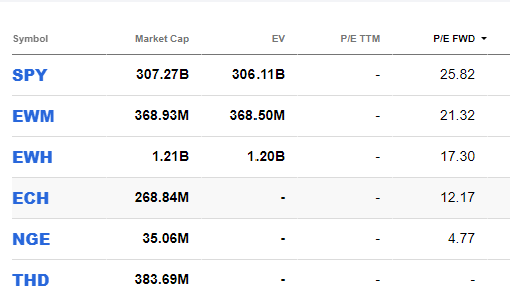

- The emerging market ETFs are cheaper than the S&P 500.

- The EWM, the most expensive of the group, trades at 21 times forward earnings. That's less than the 26 for the S&P 500.

- For investors that think the dollar weakens further and risk appetite continues to grow, some laggard emerging markets may offer attractively-priced bets.