Market News

UK House Prices Decline for the First Time in Three Months - BLOOMBERG

, Bloomberg News

, Source: Moneyfacts

(Bloomberg) -- UK house prices fell for the first time in three months, suggesting the market may be stagnating due to high mortgage rates and strained affordability.

Nationwide Building Society said the average price of a home dropped 0.2% last month after 0.7% gains in each of the two previous months. Economists had expected a small increase on the month.

Britain’s property market has defied expectations for a sharp drop in prices last year, delivering modest gains since September when the Bank of England brought to a halt its quickest series of interest rate increases in decades. But prices remain at levels that many buyers find difficult to finance, especially with the benchmark lending rate at a 16-year high.

“Activity has picked up from the weak levels prevailing towards the end of 2023 but remain relatively subdued by historic standards,” Robert Gardner, Nationwide’s chief economist, said in a report Tuesday. “This largely reflects the impact of higher interest rates on affordability.”

The average cost of a home is now £261,142 ($327,590), according to Nationwide’s reading, which is the first of several indicators of the market due out this month. That’s 4.6% below the peak recorded in late 2022. Prices have now grown 1.6% from a year ago.

“Sellers will need to remain patient,” said Jason Harris-Cohen, chief executive officer of Open Property Group. “The higher cost of borrowing continue to prove problematic.”

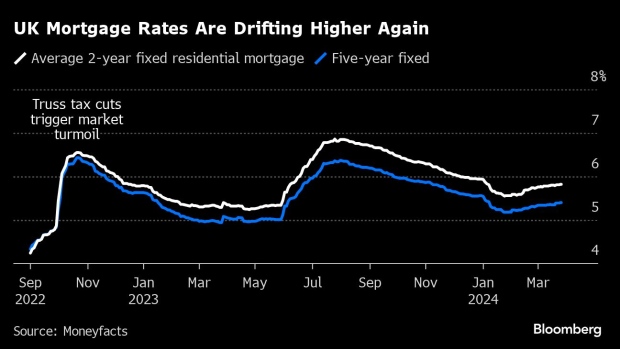

Mortgage costs have risen slightly in the past few months as investors reined in expectations for how much the Bank of England will cut its key rate this year. At one point, markets had priced in 1.5 percentage points of reductions for 2024. Now they’ve fully priced in two quarter-point cuts and the strong prospect of a third.

“The recovery is still likely to be heavily influenced by the trajectory of interest rates,” Gardner said.

Prices in London rose 1.6% from a year ago, making it the best performing region in the south of England. Northern Ireland enjoyed a 4.6% surge, the strongest region in the survey.

(Updates with detail from the report.)