Market News

Naira Pushes to Post-Devaluation High as Rate Hikes Get Traction - BLOOMBERG

BY , Bloomberg News

- Central bank tightening, dollar inflows aid Nigerian currency

- Goldman sees naira rallying to 1200/dollar within 12 months

, FMDQ, Bloomberg

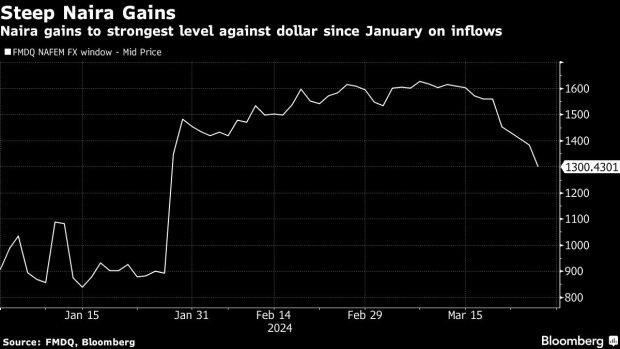

(Bloomberg) -- Nigeria’s battered currency continued to advance following another interest-rate increase by the central bank, reaching its strongest level against the dollar since being devalued in January.

The naira has rallied 8% this week on the official market to close at 1,300 per dollar on Wednesday, the latest date for which pricing is available, as investors welcomed a 200 basis rate hike that lifted the central bank’s benchmark to 24.75% the day before.

That move took the central bank’s cumulative tightening to 600 basis points in a matter of weeks and Governor Olayemi Cardoso said policy actions, as well as efforts to boost local dollar liquidity, were helping to stabilize the currency.

Analysts at Goldman Sachs came to the same conclusion as the Central Bank of Nigeria — that the combination of rate hikes and better capital inflows signal a “turning point” for the naira.

“We largely agree with the CBN’s assessment and see further currency upside, with our FX strategists forecasting an appreciation to 1200 naira versus the dollar within the next 12 months,” Goldman analysts Andrew Matheny and Bojosi Morule wrote in a research note.

Naira gains have now pushed it to the highest level since late January, when the authorities stopped supporting it around 900 per dollar and it quickly slumped to a 1,627/dollar low on March 8.

The steep drop was its second devaluation since President Bola Tinubu relaxed currency controls in June under reforms aimed at attracting foreign capital and boost the economy.

The naira has also improved on the unofficial market to 1,315/dollar, according to Abubakar Mohammed, chief executive of Forward Marketing Bureau de Change Ltd., which tracks the data in the nation’s commercial capital, Lagos.

The narrowing gap between the two markets, which had been as wide as 30% a few months ago, is making strides toward meeting Tinubu’s goal of unifying the naira’s exchange rate.

Local dollar liquidity has also improved, climbing 20% to $416 million on Wednesday compared to the previous day, said Lagos-based brokerage Chapel Hill Denham. That’s the highest level since Feb. 6, according to data from trading platform FMDQ.