Market News

NGE - Key Considerations For Prospective Investors - SEEKING ALPHA

Summary

- Nigeria's restrictive FX policies, unhealthy dependence on oil exports, and unremarkable FDI flows make the Naira vulnerable.

- Dangote Cement has benefitted from a convalescing infrastructure rebound across Africa but its long-held pricing power could be at risk.

- Nigerian banks have coped relatively well since the pandemic but could face elevated credit risks once the regulatory forbearance expires.

- NGE’s valuations are dirt-cheap and it does look oversold relative to other African equities.

Introduction

Investors looking to exploit the dynamics within Africa’s largest economy-Nigeria may consider the Global X MSCI Nigeria ETF (NGE). NGE appears to be a concentrated bet with a portfolio of only 20 stocks that are either headquartered or listed in Nigeria and carry out the majority of their operations in the country.

In this article, I will attempt to bring to light some of the major considerations that prospective investors should be mindful of whilst approaching NGE.

FX considerations

Access to NGE’s limited portfolio of 20 stocks comes at a rather steep price, as exemplified by an inordinately high expense ratio of 0.89%; conversely, something like an iShares MSCI South Africa ETF (EZA) or a VanEck Vectors Africa Index ETF (AFK) are available at lower expense ratios of 0.59% and 0.79% respectively. Do note that the “management fee” of NGE per se is fairly acceptable for a frontier market-based ETF at 0.68%, but in addition to that, the fund also throws up a rather elevated “other expenses” component which accounts for 0.21%. I’d like to think that much of this is on account of Nigeria’s restrictive foreign exchange rate management that places a lot of encumbrances on the ready conversion of Naira to USD via the official route. Because of these restrictions, NGE's administrators may not quite be able to convert or repatriate the Naira-dominated holdings to USD at appropriate rates to meet redemption requests in a timely manner. To mitigate this, NGE may then have to borrow USD to meet certain regulatory obligations of running the fund which will likely bump up the expense ratio.

Ambiguous FX policies (there is a significant gap between the official FX rate and the parallel market rates) and a generally low-interest rate regime (last year the CBN cut its monetary policy rates by 200 bps in May and September) make it challenging for the Naira to benefit from sustained net portfolio inflows. Ordinarily, the specter of remarkably high inflation (inflation recently hit 4-year highs and is currently hovering around the 18% mark) should have jolted the central bank to hike rates but given a subdued growth outlook and worrying employment conditions in areas such as agriculture and manufacturing means low rates will likely linger. There is also a school of thought that believes that much of the inflation stems from supply-side related issues on the food side where a lot of worker migration and mobility was restricted during the pandemic; it is believed that with the harvest season around the corner things may return to normal. Regardless, inflation in Nigeria is still likely to be around double digits for the rest of the year and will only likely drop to single digits sometime in H1-22.

With oil prices having recovered substantially since the pandemic lows, this is less of an issue now, than it was previously but the Nigerian economy’s heavy reliance on oil exports brings its own share of problems in managing external shocks; just for some context, back in the 60s oil only accounted for 12% of the nation’s total exports; these days it is closer to 90% of total exports, making this a major swing factor in influencing terms of trade and balance of payments. Conversely, some of the other comparable oil-rich nations such as Ecuador, Mexico, Egypt, Oman have done well to reduce their dependence on oil over the last years.

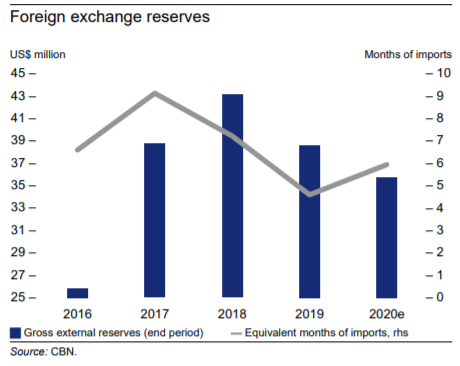

Oil trading above $60 a barrel is welcome news for the Nigerian central bank as gross FX reserves required for firefighting potential Naira depreciation are not in the best shape, and have been on a declining trend over the last three years (at the end of last year it stood at $35bn implying import coverage of 5.9 months).

Source: World Bank

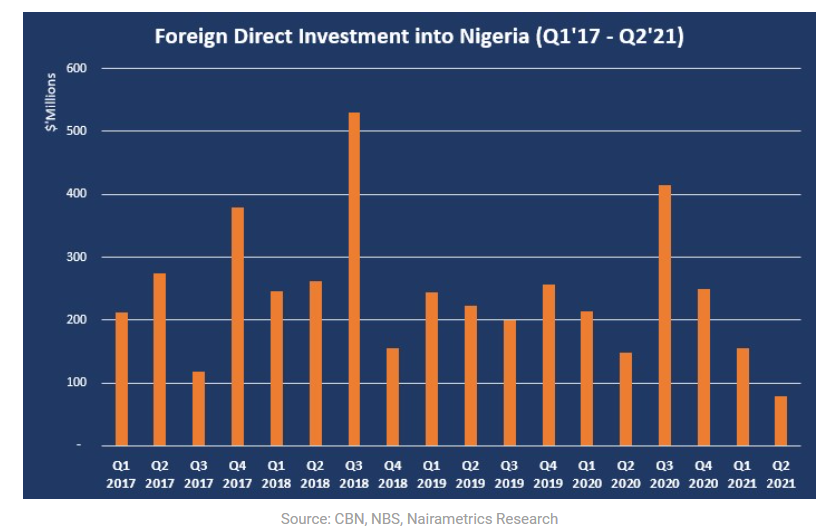

As the global economy rebounds, the Naira could also benefit from increased remittances from abroad (Nigeria's second-biggest source of current account inflows), but investors should also note the lack of progress on the FDI front which is a more consistent barometer of sentiment. Despite the brimming promise of a slew of tech start-ups in Nigeria, FDI flows into the country haven’t really picked up a great deal over the years and are currently hovering closer to 11-year lows.

Source: Nairametrics

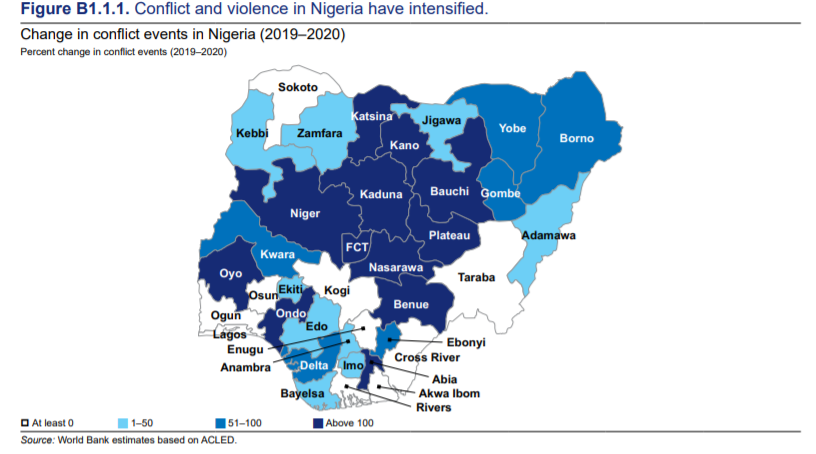

I’d like to think much of this is on account of the insecurity issues that have plagued the country for years and is not something that can just be brushed away. What makes it doubly hard is that a lot of the marginally employed or unemployed youth who could be potentially be used to mitigate the labor shortage in avenues such as agriculture and manufacturing are currently being lured by criminal organizations and insurgent groups.

Source: World Bank

Dangote Cement

NGE’s top holding is a cement company- Dangote Cement PLC that accounts for over 15% of the total portfolio. What makes Dangote particularly appealing is that it’s a play not just on the convalescing infrastructure dynamics within Nigeria (Nigeria plans to spend $5.6bn on infra-related activities) but across nine other sub-Saharan African countries as well. Currently, Dangote is on a roll and is delivering solid numbers in its home turf as well as other countries, as a lot of pent-up work has come through in areas such as real estate, commercial construction, highways, ports, etc. All in all, in the recently concluded quarter, the company delivered record revenues of nearly $700bn Naira which resulted in annual growth of 45%, the biggest jump in 9 years. EBITDA margins meanwhile gained more than 500bps and crossed the 50% landmark coming in at 50.8%.

It must be noted that Dangote is currently experiencing something akin to a goldilocks scenario where it is benefitting from both strong volumes and heightened price realizations. Sales volumes were up 26% annually hitting 15.3 metric tons (Nigeria contributed 9.9MT whilst the other regions accounted for 5.5MT). Price realizations have been robust for quite some time now particularly in Nigeria; Back in 2016, when recessionary effects had begun to impact the economy, Nigerian cement firms actually hiked prices to counter weak volumes. Then, in 2019, the country shut down its borders restricting exports which prompted these firms to hike prices again to cope with the export revenue attrition. All in all, it is estimated that cement prices in Nigeria have doubled over recent years from 2000 naira a bag to 4000 nairas a bag (incidentally the World Bank believes that African cement prices are 183% higher than the world average).

So far so good, but I don't believe Dangote's pricing power on account of the oligopolistic structure in the domestic market is sustainable and something's got to give. The market is currently controlled by three players notably Dangote which has a 60% market share (Lafarge Africa has a 22% share whilst Bua Africa has an 18% share). We've seen some discontent regarding the status quo in the cement sector and reports suggest that the authorities there are looking to loosen licensing requirements in order to bring onboard more players and strengthen the competitive field. Currently, a motion has been adopted in the upper house senate but it will still need the executive to implement them. If this were to come through, it will most certainly erode some of Dangote's competitive positioning.

Financials’ sector

NGE is heavily exposed to the financials sector which accounts for 45% of the total portfolio, nearly twice as much as the next largest sector- consumer staples. Last year, the credit risks surrounding this sector were particularly high, more so when you consider that oil accounted for ~30% of total banking credit but as of Feb-21, the NPL ratio for Nigerian banks was only around 6.3%, in line with the pre-pandemic phase implying that things haven’t worsened considerably “as yet”.

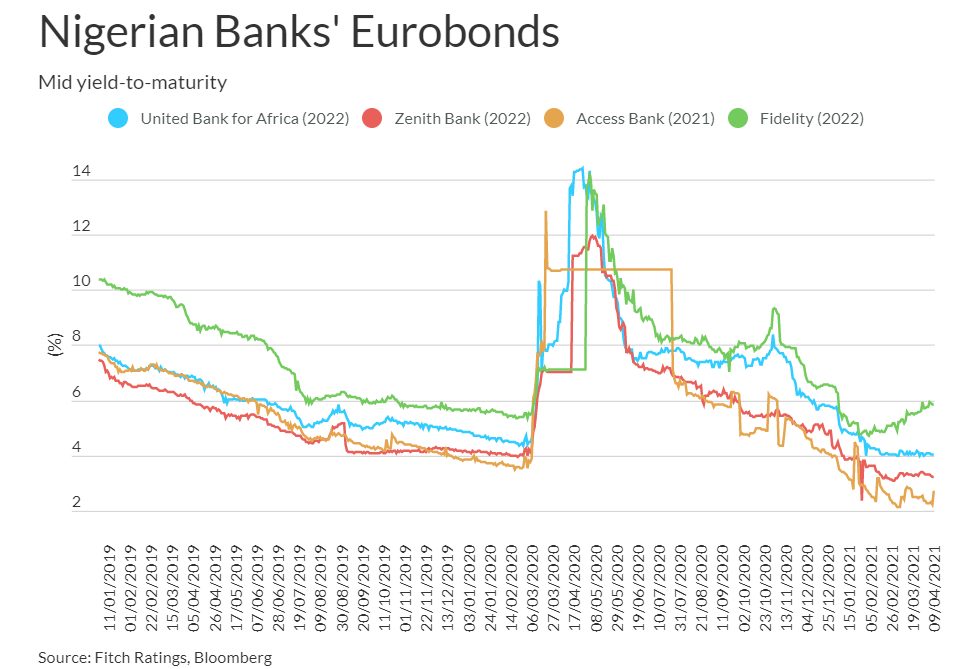

Since late last year, a couple of Nigerian banks (First Bank of Nigeria and Ecobank Nigeria) were also able to tap the international capital markets raising $650m in aggregate by way of Eurobonds; interestingly both issues were heavily oversubscribed, implying the degree of confidence with which foreign investors view the banking sector. The improved confidence is also being reflected in the yields of some of the notable Nigerian Banks’ Eurobonds which have come off substantially since peaking in March-2020.

Source: Fitch Ratings

That said I would urge investors to not get too carried away; firstly, net interest margins will likely be restricted for longer as it does not look like the central bank will be raising rates any time soon. Then crucially I also feel that credit risks are not being discounted entirely and are currently being controlled by regulatory forbearance plans which will be in place until March 2022. Once this expires, if growth conditions don’t pick up substantially, the repayment abilities of certain business segments could come under pressure. Do note that the capital adequacy ratios (CAR) of Nigerian banks (as of Feb 2021) stood at rather healthy levels of 15.2%, up 30bps YoY, but as per stress tests conducted by the CBN in Dec-2020, it was estimated that if 25% of the unrestructured loan portfolio of banks were to move to NPL status, the CAR would then drop to less than 10%!

Closing thoughts

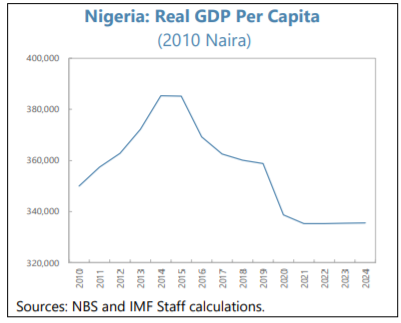

When all is said and done, you’re basically looking at a country that is expected to grow at ~2-2.5% or thereabouts, in the foreseeable future (yes I acknowledge the strong Q2 reading of 5% but much of this is on account of weak comps, where a year ago, the GDP had declined by over 6%). The GDP outlook is nothing to write home about, more so when you consider that the sub-Saharan African region is expected to grow at a higher rate of 3.4%. More worryingly, the IMF believes that Real GDP per capita will actually decline and then flatten as economic growth will lag population growth!

Source: IMF

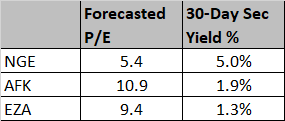

All in all, the inherently weak growth profile coupled with heightened inflation and a highly sensitive external position are reflected in the valuations of NGE which currently trades at dirt-cheap levels; on a weighted average forecasted P/E basis, you can currently pick up NGE at just 5.4x; this represents a substantial discount of 40-50% to the corresponding forecasted P/E multiples of other African based options such as the iShares MSCI South Africa ETF (EZA) or a VanEck Vectors Africa Index ETF (AFK). In addition to that, you also get to lock in a fairly attractive 30-day SEC yield of nearly 5% ( AFK and EZA only offer 1.88% and 1.29% respectively).

Source: YCharts and ETF home page

Even on the relative price charts, Nigerian equities still look oversold versus the broader African market. Admittedly, the relative popularity of Nigerian equities has been eroding since the start of 2018 (as can be seen from the consistent descending channel over the last 3 years), but we can also see that pre-pandemic, this ratio typically ranged from 0.6-0.925; currently, it still feels very oversold, trading at around the 0.5 mark. If you're big on mean-reversion you'd hope it could recoup some of its pre-pandemic range above the 0.6 mark, implying potential outperformance vs other African equities.

Source: StockCharts

To sum up, Nigeria isn’t the most attractive geography to be exposed to and it does have its fair share of risks but if you’re someone with an aggressive risk appetite and think that oil has further upside, it wouldn’t be the worst thing in the world to consider building a small position in NGE as valuations look rather tasty and there’s scope for some mean-reversion on the relative strength charts.