Market News

Bitcoin Tops $67K on Dovish Fed Remarks; Ether Rebounds From SEC Fears, DOGE Soars - COINDESK

Fed policymakers maintained their outlook for three rate cuts by the end of the year, alleviating market concern of a more hawkish stance.

Bitcoin price on March 20 (CoinDesk)

- Bitcoin topped $67,000, a more than 10% jump from lows hit hours earlier, after the Fed's decision on rates and comments about interest rates.

- Ether rebounded from a drop prompted by fears of more SEC regulation, while dogecoin soared on Coinbase's plan to list futures contracts.

Crypto markets bounced sharply higher and bitcoin (BTC) targeting $67,000 on Wednesday as U.S. Federal Reserve Chair Jerome Powell hit a dovish tone after and the central bank maintained its outlook for three rate cuts this year despite hotter-than-expected inflation figures.

Bitcoin (BTC) hit a $67,781 daily high, recording a more than 10% recovery from level seen hours earlier. Ether (ETH) erased its 6% dip earlier in the day that had been triggered by news reports about the Ethereum Foundation facing a confidential inquiry from an unnamed government and the U.S. Securities and Exchange Commission considering classifying the asset as a security.

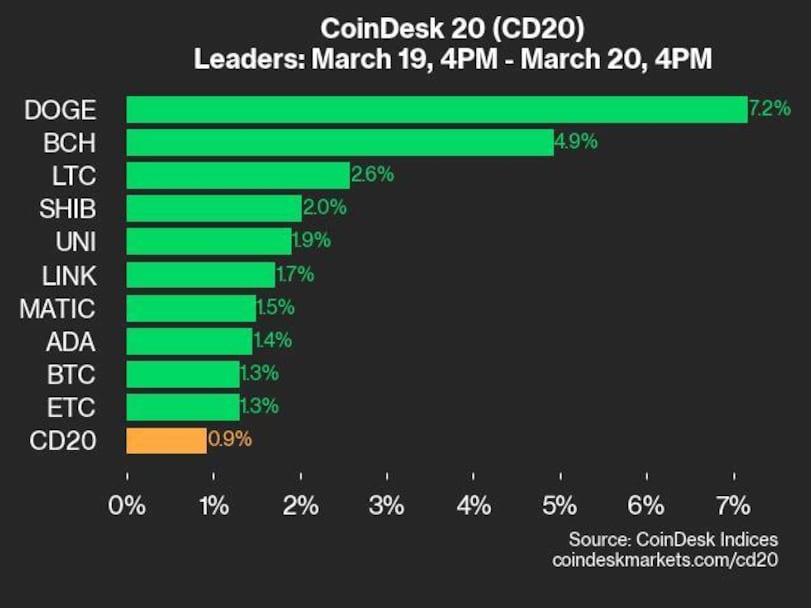

Dogecoin (DOGE), litecoin (LTC) and bitcoin cash (BCH) led gains among major cryptocurrencies as people finally noticed a Coinbase plan, posted on a U.S. regulator's website several weeks ago, to offer futures contracts on them. The broad-market CoinDesk 20 Index (CD20) was up nearly 3% over the past 24 hours.

ADVERTISEMENT

ADVERTISEMENT

Traditional markets also climbed higher. The S&P 500 index jumped nearly 1% to a fresh all-time high, while the tech-heavy Nasdaq-100 gained 1.3%. The U.S. dollar index (DXY), which measures the strength of the dollar against other major currencies, declined nearly 0.7% from its session high, signaling a greater risk appetite among investors.

Digital asset prices suffered a steep correction over the past week, with BTC enduring its largest daily loss since the collapse of FTX in November 2022, as market participants turned risk-averse ahead of the Fed's Wednesday decision, fearing that last month's stickier inflation reports could deter the Fed rate cut plans. Wednesday's Federal Open Market Committee (FOMC) concluded with policymakers keeping interest rates and rate cut plans steady, removing the risk of a more hawkish scenario that had weighed on asset prices.

Powell said during a press conference that "we are making good progress on bringing inflation down," despite the higher inflation readings.

"Fed expects slightly higher inflation but not enough to derail their dovish inclination," Fejau, an analyst at market analytics firm Reflexivity Research, said in an X post. "Up only."